Attempting a second policy U-turn in less than a decade – have we gone full circle?

In the country which was the first to liberalise its airline industry some 30 years ago, the U.S. Department of Justice marked this month what could be a 180° change in policy by challenging the proposed merger of US Airways and its ailing rival American Airlines. If this is really a U-turn, it only sets us back to the situation that prevailed at the end of the 20th century when the proposed acquisition of US Airways by United Airlines was fiercely opposed.

The first U-turn actually occurred in 2006, after years of systematically opposing airline mergers, when the regulators allowed Continental to merge with United Airlines, Northwest to join forces with Delta Airlines, and US Airways to merge with American West, to name just the most important transactions that gradually crystallized the consolidation of the airline industry in North America and inspired European airlines to attempt the same.

Disruption : The emergence of a new business model

Until the 1970s, air travel was smart, prestigious, expensive and regarded as a privilege enjoyed by the appropriately named “jet set”. But things were about to change. The liberalisation allowed new players to emerge with a very different business model, cutting the frills that provided passengers with no real additional value, such as glitzy sales offices on Park Avenue, London’s Regent Street or the Champs-Elysées. Low-cost airlines were born, flying their aircraft at close to full capacity and making air travel affordable rather than exclusive.

Next came the smarter strategy of variable pricing, adjusting the offering to the demand at a micro-level and thereby yielding a far better income by selling last available seats at a far higher cost than the first cheap ones on any flight. At first the major established airlines looked down upon those “cheap” nasty would-be competitors and attempted to resist the trend towards flexible pricing. Today, flexible pricing is the norm in air travel, even for business or first class seats. The rest is history.

It only took ten years after deregulation for the airline industry in the USA to become chronically loss-making, as most efforts to adapt to the new market reality were unfortunately off-set by various political crises and downturns in the world economy. Some of us may still have fond memories of Pan-Am, TWA and Eastern Airlines – absolute monoliths in their own time, but all three are gone now, having vanished faster than the dinosaurs did when our planet was hit by a giant meteorite.

The Regulators’ schizophrenic reaction

Faced with the emergence of these new lean competitors, established airlines had two choices : emulate these new players through ruthless cost cutting and the removal of all “frills” in the service provided to customers – which could end up damaging the company’s brand image and is difficult to implement in a highly unionized environment – or aim for a quantum leap in scale to share the cost of the infrastructure required to run a full service airline, by acquiring or merging with other airlines.

The regulators’ first reaction was to oppose all industry consolidation attempts, feeling that these would reduce the number of direct flight routes which consumers enjoy, thereby forcing them to transit though hubs, and that the cost of air travel would rise sharply as soon as the competitive pressure is alleviated.

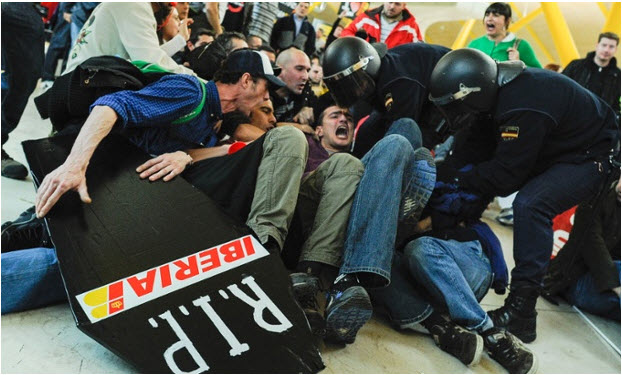

It took the financial collapse of some of the major airlines for the regulators to realize that full service airlines had no choice other than to transform their cost structure. This prompted the first U-turn, in 2006, which opened the door to frantic M&A activity in the airline industry in North America as well as on the other side of the Atlantic, with Air France and KLM joining forces, British Airways swallowing up British Midland in spite of Virgin Airlines’ vehement protest, and the IAG group declaring its intention to make a series of significant further acquisitions once the British Airways and Iberia merger has been fully digested.

Panic reaction – or strategic U-Turn ?

A merger between US Airways and American Airlines would create the world’s largest airline, and one can understand why the US Department of Justice filed a civil suit against that merger on 13th August. Nevertheless, American Airlines has been under Chapter 11 bankruptcy protection ever since November 2011, so either some form of merger will take place as US Airways and American Airlines have vowed to defend their case, or American Airlines will be torn apart and absorbed in bite-size chunks by the rest of the industry.

Either way, this will represent a significant step towards the consolidation of the airline industry.

The recent reaction of the U.S. Department of Justice was probably more of a knee-jerk than the manifestation of a strategic re-think which would mark a real U-Turn. That Department, together with six state attorneys general, and the District of Columbia, may just have voiced the politically correct antitrust concerns which a merger of this magnitude deserves …

IAG will be observing the situation with interest. If the US Airways – American Airlines merger goes ahead, nobody will be able to oppose the series of acquisitions AIG envisage carrying out in the years to come. And if American Airlines are left to disintegrate, there will be interesting pieces for IAG to choose from.

Let’s watch this space. In the meantime, sit back, relax and enjoy your flight !