Similar origins – different trajectories

Ferrero’s bid for Thornton’s marks the end of just over one century of history, as yet another British chocolate household name will be swept up by a foreign group, following in the footsteps of Cadbury in 2009 and Rowntree in 1988. This will leave the relative newcomer Hotel Chocolat as the only significant specialised independent British owned chocolate manufacturer and retailer.

Both Thornton and Ferrero began as little corner shops; their history is closely associated with their founding families. But that is probably where the comparison stops. Whereas Ferrero developed over the years into a formidable marketing machine, a game changer in the chocolate industry, Thornton remained anchored in tradition. Oddly, it is that traditional image that appears to have attracted Ferrero; the remaining question being whether Ferrero will manage to brush away the “dusty” and “passé” aspects of that tradition, and fully exploit the concept of “authenticity” that underlies tradition. Given their strong track-record as powerful communicators, transforming the image of Thornton’s is probably not beyond Ferrero’s reach, but it will be quite a task…

Both Thornton and Ferrero began as little corner shops; their history is closely associated with their founding families. But that is probably where the comparison stops. Whereas Ferrero developed over the years into a formidable marketing machine, a game changer in the chocolate industry, Thornton remained anchored in tradition. Oddly, it is that traditional image that appears to have attracted Ferrero; the remaining question being whether Ferrero will manage to brush away the “dusty” and “passé” aspects of that tradition, and fully exploit the concept of “authenticity” that underlies tradition. Given their strong track-record as powerful communicators, transforming the image of Thornton’s is probably not beyond Ferrero’s reach, but it will be quite a task…

Once an up-market purveyor of luxurious chocolates, Thornton’s appears to have dispersed itself over the years, opening its own retail boutiques and diversifying into other categories of indulgent foods, notably ice cream. In doing so, at no point did Thornton lead or even anticipate consumer trends, thereby missing the shift in taste preferences towards darker and more bitter chocolate compared to what consumers demanded in the 1980s and 1990s, and leaving the door open for the likes of Lindt to occupy that space.

Retail chains – Thornton’s last (and failed) attempt

With sales volumes declining below the critical mass that would be required to profitably run its large Derbyshire plant, and with insufficient cash-flow to justify its large network of retail boutiques, Thornton decided to aim for a step change in sales volumes by entering large retailers, without fully thinking through how their presence in hypermarkets and discount outlets might impact the brand’s already eroded premium image. Transacting with giants such as Tesco requires a skill set, supply chain efficiencies and ways of working which Thornton appear not to have grasped, and therefore the mass retailer strategy that was supposed to revive Thornton after many years of continued declined turned out to be a failure.

There are only so many successive profit warnings a company can issue before it loses all credibility with its shareholders. Thornton was getting to that point, and the arrival of Ferrero in that troubled environment can be considered as the deus ex machina that will hopefully prevent Thornton’s from going into terminal decline. By the own admission of Thornton’s former Chairman Peter Thornton, grandson of the chocolate maker’s founder, without Ferrero’s offer “The decline in performance would have continued and I think the decline would have been fatal.”

Radical change for Ferrero too

The decision to make a significant acquisition to fuel growth marks a radical change in strategy by Giovanni Ferrero, months only after the passing away of his father who founded the company back in the 1940’s and became Italy’s richest citizen. Until now, the Ferrero empire had grown organically and its acquisitions were focused on increasing production capacity and securing the supply of ingredients: today Ferrero is the world’s biggest consumer of hazelnuts, with 25% of the world’s annual supply used in its production plants. So why depart from such a brilliantly successful strategy?

Giovanni Ferrero argues that the acquisition of Thornton’s will pave the way for Ferrero to rapidly get a strong foothold in Britain, a market where the per capita consumption of chocolate and confectionery in general is high. However, it did not take any acquisitions for Ferrero to become extremely successful in Germany where the retail scene is harsh and competitive, so why acquire a struggling company to develop in the UK? Maybe there is an intention to gradually reduce the group’s reliance on Hazelnuts, the price of which has risen steadily in recent years. That, combined with fluctuating costs of cocoa caused by failed crops and the risk of a global shortage within a decade, means that some diversification may pay dividends over time, branching out in sweets and other types of confectionery.

Seeking the common ground

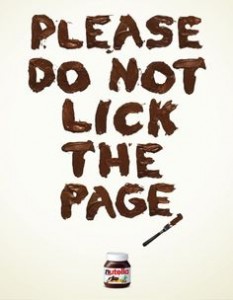

In the meantime, it will be interesting to observe how the quintessentially British Thornton company will fold into the Ferrero Group which bears the hallmark of its founding family and of Giovanni Ferrero, heir of the Ferrero dynasty, who appears keen to affirm his strong leadership. Ferrero have stated that the Derbyshire factory will be maintained, but have not commented on how much may change within its walls. However, as the world continues to gobble up ever increasing quantities of Nutella®, Kinder® chocolates and TicTac® sweets, the underused capacity in Derbyshire may be put to good use.

Importantly, no comment has been issued as to where the British company’s management will be located, nor what its remit will be within the Ferrero group. That was probably wise as it may take a while to determine how much of a shake-up is required to rectify Thornton’s past errors, put the brand back onto a path for success, and use that platform as a Trojan Horse to accelerate the growth of Ferrero’s product portfolio in the UK.

Meanwhile, an imaginative competitor is succeeding where Thornton failed

An interesting example that brilliantly illustrates the value and potential of differentiation is the emergence and rapid growth in the UK of Hotel Chocolat since 2003. Previously named Choc Express (see how some names can project a sense of premium exclusivity and others convey mere convenience), Hotel Chocolat opened its first retail boutique in Watford (not in London’s Bond Street which is more suited to super-premium brand Godiva), and has focused on the premium end of the chocolate market, with strong visual appeal and a packaging that is miles away from the traditional (boring) box of chocolates that can be found on any supermarket shelf.

To further distance itself from mass market chocolate manufacturers, Hotel Chocolat acquired it’s own cocoa plantation on the West Indies island of St Lucia in 2006, on which it opened the Boucan Hotel four years ago. So yes, there really is a “Hotel” Chocolat and, more importantly, there is a space on the seemingly mature and crowded chocolate and confectionery market in the UK for a new-comer that arrives with fresh, fun ideas and can satisfy the consumers’ desire for self-indulgence. Hotel Chocolat received the Emerging Retailer of the Year award from Retail Week, and was also nominated as one of Britain’s CoolBrands®, voted for by marketing experts, business professionals and thousands of British consumers whose input was collected by the Superbrands UK panel.

A quick glance above at the illustrations of this year’s Thornton’s and Hotel Chocolat’s summer collections as published on their respective websites leaves no doubt as to which of those two brands has knocked the other off the pedestal of premium chocolate brands.

So what’s next?

As a privately owned company, Ferrero does not need to disclose its strategy to the world, and nobody at this stage can be certain of what is going through Giovanni Ferrero’s mind. Does he really intend to revive the Thornton brand? Can the Thornton retail outlets be used as a channel for a premium Ferrero/Thornton range whilst Nutella, Ferrero Rocher and Kinder® products continue to flow through high-street shops and retail chains? How important are the Derbyshire factory and the know-how of some of its staff to Ferrero’s global manufacturing foot-print?

As a privately owned company, Ferrero does not need to disclose its strategy to the world, and nobody at this stage can be certain of what is going through Giovanni Ferrero’s mind. Does he really intend to revive the Thornton brand? Can the Thornton retail outlets be used as a channel for a premium Ferrero/Thornton range whilst Nutella, Ferrero Rocher and Kinder® products continue to flow through high-street shops and retail chains? How important are the Derbyshire factory and the know-how of some of its staff to Ferrero’s global manufacturing foot-print?

My many years spent at Diageo, and in United Distillers before that, have given me a number of opportunities to see how difficult, painstaking and costly it can be to attempt the revival of a tired brand. Tired brands often enjoy a high level of notoriety, and many marketers will see this as a fantastic short-cut compared to the time and investment it usually takes to build any awareness of a new brand. But what if a brand is renowned for all the wrong reasons? Changing well anchored perceptions can be more difficult that building a brand image from scratch. If Ferrero manage that feat with Thornton’s, they will again have proved their marketing genius.

Meanwhile, let us hope that Thornton’s decline will not be accelerated by the upheaval caused by their integration into the Ferrero group, and that the latter will not get distracted by this integration to the detriment of its sharp marketing and sales focus. That will depend on how well the post acquisition integration will be planned and orchestrated.

Alcatel-Lucent, like most of the major telecommunication equipment providers, is today the result of a number of acquisitions and business integrations. Alcatel and Lucent’s merger in 2006 triggered the merger of Nokia Networks with Germany’s Siemens. As an after-shock five years later, Ericsson acquired Nortel’s wireless networking business, prompting Nokia to buy out Motorola’s infrastructure division…

Alcatel-Lucent, like most of the major telecommunication equipment providers, is today the result of a number of acquisitions and business integrations. Alcatel and Lucent’s merger in 2006 triggered the merger of Nokia Networks with Germany’s Siemens. As an after-shock five years later, Ericsson acquired Nortel’s wireless networking business, prompting Nokia to buy out Motorola’s infrastructure division…

In late August, the world’s largest breakfast cereal producer Kellogg Co expressed its interest in acquiring all or at least a controlling stake in Egypt’s Bisco Misr, the country’s reputed manufacturer of confectionary, cakes and biscuits.

In late August, the world’s largest breakfast cereal producer Kellogg Co expressed its interest in acquiring all or at least a controlling stake in Egypt’s Bisco Misr, the country’s reputed manufacturer of confectionary, cakes and biscuits.

However, being the world’s Nr 1 in an important consumer product segment and enjoying over 100 years of company history does not guarantee victory when it comes to seeking further expansion. Abraaj Asset Management, the middle eastern private equity company founded in 2002 in Dubai now growing towards global presence with hubs in Istanbul, Mexico City, Mumbai, Nairobi and Singapore, is ideally placed to understand the needs and potential of their nearby rapidly developing economies. No sooner had Kellogg revealed their intentions regarding Bisco Misr, that Abraaj jumped into the game and has since kept beating each of Kellogg’s bids.

However, being the world’s Nr 1 in an important consumer product segment and enjoying over 100 years of company history does not guarantee victory when it comes to seeking further expansion. Abraaj Asset Management, the middle eastern private equity company founded in 2002 in Dubai now growing towards global presence with hubs in Istanbul, Mexico City, Mumbai, Nairobi and Singapore, is ideally placed to understand the needs and potential of their nearby rapidly developing economies. No sooner had Kellogg revealed their intentions regarding Bisco Misr, that Abraaj jumped into the game and has since kept beating each of Kellogg’s bids.

For many, the west will be remembered for poking the fire and giving the population of many Arab nations the confidence of turning discontent into the outright uprising that spread like wild fire, which the west dubbed “The Arab Spring”. Spring is the season of new life, a season of clement weather after harsh winters, the flourishing of Nature with the promise of rich crops and prosperity. Instead, having praised the courage and determination expressed in the uprising that toppled governments across the region, many people will feel that the west did not have much to offer as a substitute nor much support to evolve towards renewed stability and governance, propelling many of those countries towards a wide vacuum which has left the door open to the sprouting of every form of extremism.

For many, the west will be remembered for poking the fire and giving the population of many Arab nations the confidence of turning discontent into the outright uprising that spread like wild fire, which the west dubbed “The Arab Spring”. Spring is the season of new life, a season of clement weather after harsh winters, the flourishing of Nature with the promise of rich crops and prosperity. Instead, having praised the courage and determination expressed in the uprising that toppled governments across the region, many people will feel that the west did not have much to offer as a substitute nor much support to evolve towards renewed stability and governance, propelling many of those countries towards a wide vacuum which has left the door open to the sprouting of every form of extremism.