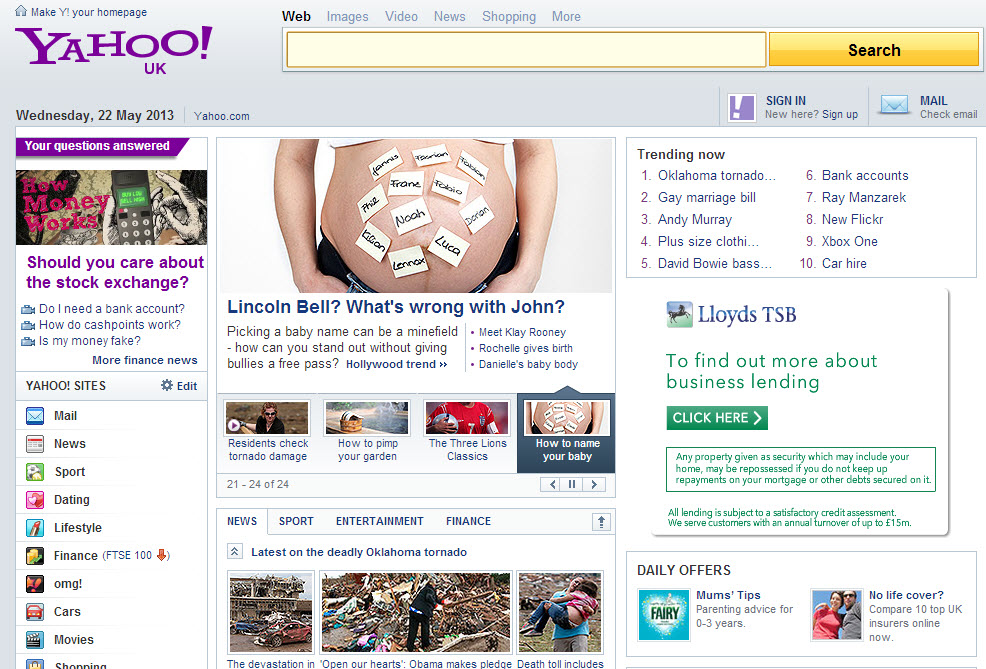

What next big decision for Marissa Mayer?

Now that Yahoo! Have cashed in on the sale of 140 million shares of Chinese on-line retail giant Alibaba (subject to a one-year lockup), there are fears – or hopes – that once she has fulfilled her promise of returning part of the cash of that sale to Yahoo!’s shareholders, CEO Marissa Mayer may make use of the rest of the cash to finance a merger with AOL, in line with a string of other acquisitions she made in recent years. Among those hoping for such an outcome is the well known investor activist Starboard Value LP who insist that combining the two organisations would not create synergies in the order of 1 billion US dollars in addition to being a tax efficient means of monetizing Yahoo!’s stake in Asian companies.

That is always a nice annuity to pocket in the future, but what is really at stake is future growth, rather than a one-time efficiency improvement, and when it comes to growth, both Yahoo! and AOL have been lagging behind the market leaders, thereby allowing the gap to grow ever wider.

That is always a nice annuity to pocket in the future, but what is really at stake is future growth, rather than a one-time efficiency improvement, and when it comes to growth, both Yahoo! and AOL have been lagging behind the market leaders, thereby allowing the gap to grow ever wider.

So how are future prospects expected to rebound as the sole result of merging to relatively slow growth mammoth businesses?

“Merger”, really? Once bitten twice shy

It is hardly surprising that AOL refused to comment on Starboard LP’s recommendations, having suffered during what Time Warner’s Jeff Bewkes himself qualified as the “biggest mistake in corporate history” in their 2001 merger that created AOL Time Warner, supposedly a merger of equals that would bring together a huge base of subscribers with “network access”, “search” and “content”. AOL was also supposed to be a catalyst that would accelerate Time Warner’s slow rate or growth. The struggle to deliver that dream began almost immediately, a dream that was short-lived as Time Warner spun off AOL in 2009.

After such a dire experience, I suspect AOL’s shareholders will think twice before attempting a repeat which based on a thinking not too dissimilar to the rationale underlying their ill-fated association with Time Warner in 2001, even more so as the word “merger” is quite semantic for what is in reality bound to be a mere “take over”.

Whilst most of the media coverage about this potential deal refers to a “merger”, Yahoo!’s market value runs at $40.5 billion compared to AOL’s mere $3.5 billion, so this would most likely be the former merely snapping up the latter, particularly as Yahoo! is sitting on $9 billion of cash. Consequently, AOL would dissolve within the greater Yahoo! galaxy.

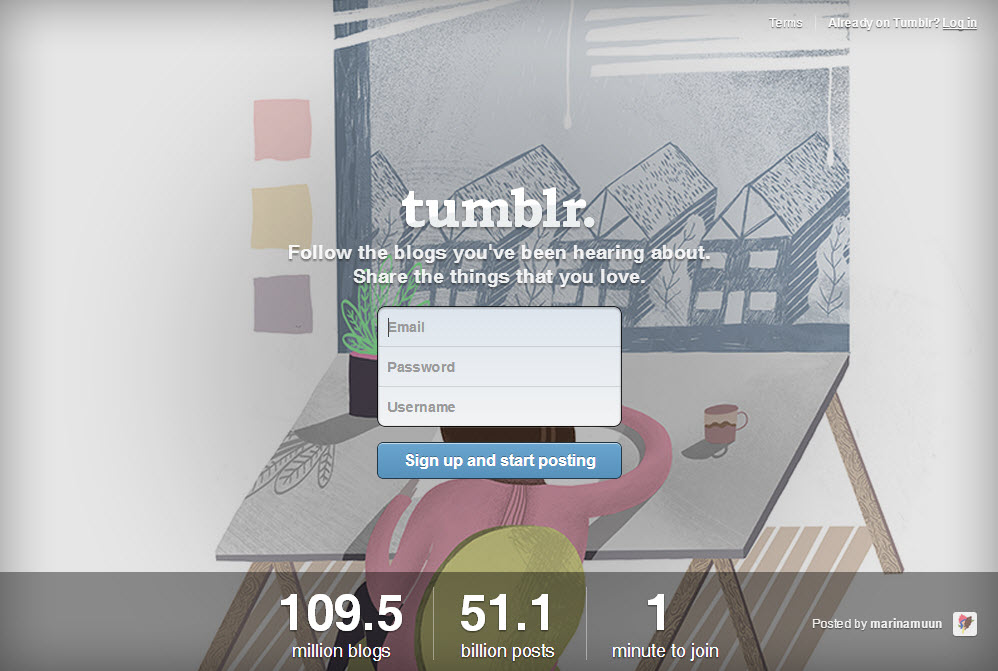

Yahoo! might as a result feel like renaming itself “Yahoo+” to reflect that it is striving to become a better and faster growing company offering a more comprehensive range of services to on-line users, mainly though AOL’s recent acquisition of Adap.tv offering on-line video programming. But will this “+” really be a plus for internet users and therefore for Yahoo! or more simply a huge distraction for management when the real prize of the game is to return to accelerated growth?

The value proposition and ingredients of growth

Some might believe that Yahoo!’s growth performance was actually quite good in recent years, however many analysts will contend that Yahoo! owes much that apparent good track record to the phenomenal contribution of its investment in Alibaba. Now that this valuable contributor to Yahoo!’s bottom line will no longer play that part in the future, something else is needed to fuel growth: either the acquisition of another high growth business, and/or learning to become a growing business again by itself again.

Value and fast growth in the internet world come from getting first-mover advantage when introducing innovative services or totally new ways of approaching something that already existed under another form. The real problem, for Yahoo! and AOL, is that the market leaders that are raking up the world’s digital advertising money are Google and Facebook, who repeatedly invent things most consumers did not even know they wanted, thereby growing the gap between themselves and the rest of the market.

Internet research company eMarketer estimates the global value of digital advertising spend to be approximately $140 billion, a third of which is captured by Google, with the number 2 player being Facebook, considerably lower down the scale but with a nonetheless respectable 8% market share. In the event of a merger, AOL and Yahoo!’s combined market share would bring them to a mere 3.5% share based on their 2013 positions from which they have both declined. That would make them the N°3, but still miles behind the two leaders…

In many global industries, the game is played between N°1 and N°2 on the market, and life can be considerably more challenging for N°3 and next followers, particularly where the gaps in market shares are significant, as they are in the case of digital advertising which is really a case of Google, Facebook and “all others”.

In many global industries, the game is played between N°1 and N°2 on the market, and life can be considerably more challenging for N°3 and next followers, particularly where the gaps in market shares are significant, as they are in the case of digital advertising which is really a case of Google, Facebook and “all others”.

Those who believe that “size matters” will not be led to believe that pulling Yahoo! and AOL together will suffice to catapult Yahoo! back to the glory of its early years. There needs to be more, something that would make Yahoo! nimble and capable of jumping into new opportunities before either Google or Facebook can occupy those spaces as they emerge.

So if it’s not growth, then what?

Following the sale of the Alibaba shares, Starboard Value LP’s Jeffrey Smith argues that Yahoo!’s tax structure is inefficient to the extent that $16 billion of additional value could be derived from more tax efficient deal structures whist monetizing its stakes in Asia. I find that number quite incredibly high but agree that most companies in this world have scope for tax efficiency improvements in their legal structures and the way they construct their M&A deals, so I’ll leave Jeffrey Smith with the argument he puts forward.

The counter-argument, in my opinion, is that in the same way as the potential $1 billion saving in overheads, tax savings are an annuity which changes the height but not the slope of a company’s value curve over time. So yes, there may well be a lot of money to be gained over the next 3 years by implementing Jeffrey Smith’s recommendations, or one may ask oneself where Yahoo! (or “Yahoo+” for that matter) will be positioned in 5, 10 or 15 years from now.

There is probably no right or wrong answer. Most of us would have been hard pressed in 1999 to imagine the breadth of uses and applications the digital world offers us today, let even how things will look by 2025 or 2030. So some will follow Jeffrey Smith’s view which equates a “go for it now and adjust later as circumstances require”, others will take a more strategy view and start thinking about what it will take – internally and/or through some acquisitions – to give back to Yahoo! the energy, saliency, innovative image and apparent invincibility of its early years.

One thing is certain: Marissa Mayer must be under tremendous pressure now to do “the right thing”, whatever the future will judge that right thing should have been.