On course for becoming the world’s number one

Last April when Holcim and Lafarge announced their intention to merge, I was not the only one to predict that this mega-merger project would be a feast for the anti-trust regulators across the world, and indeed it has been. However, given the complexity and magnitude of the deal, we must acknowledge one year down the road the accuracy with which the outcome of the regulatory process has matched the two giants’ advisors prediction as far as Europe is concerned.

Just over a decade ago, uniting Holcim and Lafarge would have been unthinkable. Regulators used to spend their time and energy scrutinizing the cement industry to detect any signs of collusion between the key operators of what had already been an oligopoly for many years. But in today’s global scale economy, European regulators have become less shy about allowing the formation of giant companies capable of capturing sizable shares of the market in major European countries; after all, Europe needs a few such global heavy-weights to avoid being completely dwarfed by Asia and the Americas.

Just over a decade ago, uniting Holcim and Lafarge would have been unthinkable. Regulators used to spend their time and energy scrutinizing the cement industry to detect any signs of collusion between the key operators of what had already been an oligopoly for many years. But in today’s global scale economy, European regulators have become less shy about allowing the formation of giant companies capable of capturing sizable shares of the market in major European countries; after all, Europe needs a few such global heavy-weights to avoid being completely dwarfed by Asia and the Americas.

Lafarge’s spokesperson mentioned last April that they and Holcim were expecting to have to divest up to 15% of the new group’s assets to secure the anti-trust authorities approval of the deal and this is where they now stand, having received the approval of the EU anti-trust authorities on the condition that a sale of that magnitude is made before the two giants proceed with their merger.

Biggest hurdle removed

It was always clear that the bulk of divestments required by the regulators would be within Europe, and many external observers (including myself) feared that obtaining an acceptable price for the sale of cement business in Europe’s saturated market might prove difficult or impossible. Divesting European assets piecemeal would have been lengthy and risky, delaying and possibly jeopardising the whole deal as the sale of all those assets was a pre-condition set by the EU antitrust regulators.

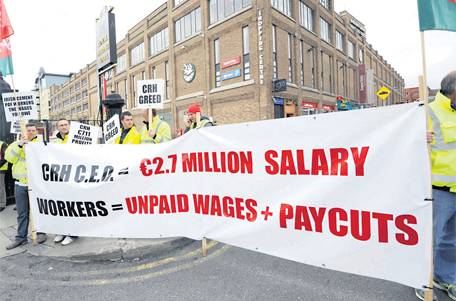

Holcim and Lafarge’s decision to auction the assets as a bundle was risky but has now paid dividends. The presence on the market of a single acquirer interested in taking on those assets as a bundle has secured the value and clarified the time-line of the merger. The Deus ex machina who has offered EUR 6.5 billion for the bundle is Cement Roadstone Holdings, better known as CRH, whose insatiable appetite for acquisitions has made the whole Holcim – Lafarge deal possible.

Just when everything is looking fine, someone spoils the game

Whereas the course of events in Europe has followed a well predicted roadmap, the unpleasant surprise on the path to Holcim and Lafarge’s union has now come from India where the regulators fear that the Holcim – Lafarge deal would cause a serious imbalance on their very vast and growing market. In an interesting and quite unusual move, India’s CCI (Competition Commission of India) required Holcim and Lafarge to publish the details of their proposed deal on their respective websites as well as in a selection of national newspapers, so that every interested party in the Indian subcontinent could have access to the relevant information and be given sufficient time to formulate comments and possible objections. This is only the second time that a merger proposal is submitted to general public scrutiny under Section 29(3) of India’s Competition Act, 2002.

Whereas the course of events in Europe has followed a well predicted roadmap, the unpleasant surprise on the path to Holcim and Lafarge’s union has now come from India where the regulators fear that the Holcim – Lafarge deal would cause a serious imbalance on their very vast and growing market. In an interesting and quite unusual move, India’s CCI (Competition Commission of India) required Holcim and Lafarge to publish the details of their proposed deal on their respective websites as well as in a selection of national newspapers, so that every interested party in the Indian subcontinent could have access to the relevant information and be given sufficient time to formulate comments and possible objections. This is only the second time that a merger proposal is submitted to general public scrutiny under Section 29(3) of India’s Competition Act, 2002.

The CCI delivered its decision earlier this month, allowing Holcim and Lafarge to proceed with their merger provided assets including large limestone reserves situated in eastern India are divested. There is a welcome proviso, however, in that these assets do not necessarily have to be sold to a competitor, consequently these forced divestments might still fetch a price which will not cause Holcim and Lafarge to cringe. They now have 30 days to respond to the CCI’s decision. India was not on the regulatory radar screen of Holcim Lafarge; this will have been a nasty surprise but is unlikely to be a show stopper at this advanced stage of the game.

Some players have won before the lottery is drawn …

Far from the challenges and uncertainty that lay ahead for Holcim, Lafarge and CRH, some of the players involved in this giant M&A scheme can already shout : “BINGO”. The number of transactions involved in the pulling together of Holcim and Lafarge, and the added opportunity of overseeing the divestments that will be required to allow the merger project to complete, are an absolute bonanza for all the banks and investment houses involved in advising the two players. Can you spot anyone missing in the impressive list of those who have advised Holcim, Lafarge and CRH: UBS, Bank of America Merrill Lynch, JPMorgan Chase, Davy Group of Ireland, BNP Paribas, Morgan Stanley, Zaoui & Co, Rothschild, HSBC, Credit Suisse and Goldman Sachs.

… for others, the work has only just begun

CRH’s EUR 6.5 billion acquisition provides them with a series of businesses in Europe, as well as in Brazil, the Philippines and Canada; a golden opportunity to leap ahead on their very ambitious growth curve. CRH are serial acquirers, well accustomed to integrating the companies; the Irish company of the 1970’s has become a global player, with some previous experience of acquiring businesses from Lafarge in recent years.

According to the Financial Times, CRH has spent some USD 24 billion on approximately 650 acquisitions since 2000. However, the acquisition of the Holcim – Lafarge bundle will be of a magnitude they have never experience before. Growing one’s business by 33% in one single step is no easy task.

As for Holcim and Lafarge, their merger remains incredibly ambitious, with this future world leader set on transforming the whole industry with products and concepts that may revolutionise modern construction. A lot of interesting developments to be observed over the coming two or three years.