Energy and persistence conquer all things (Benjamin Franklin)

After four unsuccessful bids, it is befitting that the deadline set by the U.K.’s Takeover Panel for beer giant Anheuser-Busch InBev NV to submit a fifth and final offer for SABMiller Plc. was extended to 5 p.m. GMT on 11th November : Armistice Day !

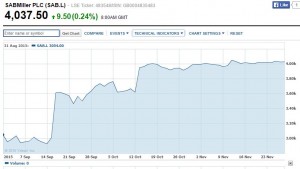

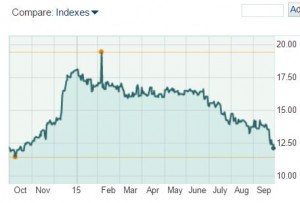

Rumours that AB InBev were about to bid for SABMiller started over twelve months ago, gaining substance shortly afterwards. What ensued was a succession of bids of ever increasing value to seduce the initially reluctant shareholders of SABMiller – until they surrendered to a staggering offer of USD 107 billion, or £ 71 billion. They can hardly be blamed for grabbing the cash and running, given that SABMiller’s share price at the end of November stands 37% higher than it was on 14th September, as a direct result of AB InBev’s mounting bids. Whilst SABMiller’s share owners might drink to celebrate having realised value growth earlier than expected, many other stakeholders are guaranteed a nasty hangover as a result of the forthcoming merger.

Rumours that AB InBev were about to bid for SABMiller started over twelve months ago, gaining substance shortly afterwards. What ensued was a succession of bids of ever increasing value to seduce the initially reluctant shareholders of SABMiller – until they surrendered to a staggering offer of USD 107 billion, or £ 71 billion. They can hardly be blamed for grabbing the cash and running, given that SABMiller’s share price at the end of November stands 37% higher than it was on 14th September, as a direct result of AB InBev’s mounting bids. Whilst SABMiller’s share owners might drink to celebrate having realised value growth earlier than expected, many other stakeholders are guaranteed a nasty hangover as a result of the forthcoming merger.

The combined business is set to rake in annual revenues of USD 73 billion, which is more than companies such as Pepsico or even Google. But more importantly, the integration of the two companies aims to generate annual cost synergies of USD 1.4 billion, a significant part of which will come from headcount cuts. With AB InBev employing 155,000 people worldwide, and SABMiller a further 70,000, it is easy to imagine how much duplication there will be at headquarter level as well as in many back-office functions. Having paid 15% more to acquire SABMiller than their initial bid of £ 38 per share, there is no doubt the pressure to realise the cost synergies very fast will be extreme.

A foreseeable domino effect on the beer market

Beyond the USD 1.4 annual savings, much of the business case underlying the acquisition of SABMiller rests on growth in Africa and Latin America. This is because AB InBev cannot expect much growth in Europe and North America where consumers are beginning to seek product differentiation and thereby generating growth at the other end of the beer market spectrum : micro-breweries or so-called “craft brewers”.

Beyond the USD 1.4 annual savings, much of the business case underlying the acquisition of SABMiller rests on growth in Africa and Latin America. This is because AB InBev cannot expect much growth in Europe and North America where consumers are beginning to seek product differentiation and thereby generating growth at the other end of the beer market spectrum : micro-breweries or so-called “craft brewers”.

Nonetheless, the combined companies’ market share in North America and the fact that AB InBev own wholesale distributors in several states of the USA might be sufficient to restrain the route to market of many smaller players and this may reduce consumer choice in bars and retail outlets; so this could be bad news for those who have thus far developed well by offering consumers something that differs from the usual mass product.

Global market share of five biggest beer companiesAnheuser-Busch InBev – 20.8%SABMiller – 9.7%Heineken – 9.1%Carlsberg – 6.1%China Resources Enterprise – 6%Source: Euromonitor, based on 2014 figures |

In spite of SABMiller selling its stake in a venture with Molson Coors for USD 12 billion and thereby letting go of the Coors and Miller brands, the combined AB InBev and SABMiller will be selling one in every three pints of beer worldwide, leaving a huge market share gap between themselves and the next player on the podium. Heineken and Carlsberg must now be furiously re-thinking their strategies; a number of other takeovers and mergers will inevitably happen as the industry seeks a new equilibrium.

According to Bart Watson, chief economist at the Brewers Association, there are already rumours about a Heineken and Molson Coors tie-up as these two companies are now seeing their main competitor become even bigger. Others are likely to follow. Some companies such as Diageo, which is now focusing on its spirits business, could stand to benefit from this new wave of upheaval on the beer market by finding an acquirer prepared to pay over the odds for Guinness as the few remaining global players grapple to keep pace with AB InBev / SABMiller. Interesting times ahead…

Africa : two different interpretations of public health

My thoughts regarding the impact this merger will have on consumer choice have not changed since the blog I published in September 2014 (“Something big could be brewing”), but one new aspect which is now surfacing is the very strong opposition and criticism of the merger which is now emanating from public health circles regarding the African continent, which is a critical growth area in the combined company’s strategy. According to Dr Jeff Collin, director of the Global Public Health Unit at the University of Edinburgh, the AB InBev SABMiller merger aims to “exploit Africa’s low per capita consumption of beer” by targeting low income consumers to generate sales growth.

In an article published in the British Medical Journal, a team of experts warn of “disturbing implications” relating to the growing alcohol related harm being witnessed in low and middle income countries. And therefore the issue is not specifically African, but also affects other regions targeted in the combined company’s growth plans, notably Latin America and China, the latter being the world’s largest beer market in which SABMiller has a joint-venture producing the country’s Nr 1 beer brand, Snow.

In an article published in the British Medical Journal, a team of experts warn of “disturbing implications” relating to the growing alcohol related harm being witnessed in low and middle income countries. And therefore the issue is not specifically African, but also affects other regions targeted in the combined company’s growth plans, notably Latin America and China, the latter being the world’s largest beer market in which SABMiller has a joint-venture producing the country’s Nr 1 beer brand, Snow.

Unsurprisingly, SABMiller see things very differently, stating that more than half of the alcohol consumed on the African continent is what they call “informal”, in other words beverages produced in unregulated facilities, ranging from home made beer brewed in a back yard to dubious distilled beverages containing potentially dangerous by-products such as methylated spirits, reminiscent of the Moonshine that was distilled during the Prohibition in the USA. Based on that premise, SABMiller see their mission as a noble task; as per their spokesperson: “The backbone of SABMiller’s growth strategy in Africa is to ensure the affordability of our beers so that local, low income consumers move from drinking poor quality, and potentially lethal, alcohol to enjoying our high quality beers made with local ingredients.”

Many people will consider that strategy to be a little cynical; but there is one undoubtedly positive element in that statement: “local ingredients”. In the beer industry, the supply chain costs can be a substantial component of the value chain because of the unfavourable weight/volume to value ratio. Consequently, unlike wine and distilled beverages, there is a strong incentive for beer to be produced locally. And that, for emerging economies, is better than burdening the balance of trade with the cost of imported drinks.

Money now vs. safeguarding against a possible longer term threat

As in the more developed economies, low and middle income economies will see a growing tension between the priorities of their public health programmes and the fiscal requirements of their treasury; migrating the production of beer from back yards and speak-easy environments to a registered and regulated business is a source of corporation tax and possibly some form of alcohol tax as well. This also promotes employment in hygiene conscious factories, which is also important in developing economies.

As in the more developed economies, low and middle income economies will see a growing tension between the priorities of their public health programmes and the fiscal requirements of their treasury; migrating the production of beer from back yards and speak-easy environments to a registered and regulated business is a source of corporation tax and possibly some form of alcohol tax as well. This also promotes employment in hygiene conscious factories, which is also important in developing economies.

The authors of the article in the British Medical Journal argue that company’s proposed expansion in low and middle income countries “echoes that of transnational tobacco companies” whilst benefiting from less stringent regulation and controls. That might be the case, but faced with the dilemma of choosing between the certainty of a stream of income and the longer term avoidance of a possible health risk, I will not be surprised if the said low and middle income economies will welcome the growth of AB InBev/SABMiller in their respective countries.

Even in the absence of strong political opposition to the merging of the world’s two largest players, implementing the integration of these huge businesses will be a monumental task. Let’s wish them luck (and perseverance), and hope this will not end up with a big hang-over for all those involved. If it does, maybe the other mega-merger which is currently under discussion, namely the USD 160 billion bid by Pfizer to acquire Allegan, will be able to provide the cure to that hang-over!

In an additional layer of legal complexity, the Bill and Belinda Gates Foundation is now attempting to sue Urs Burkard, who represents the family and is the only member of that family on the Sika Board of Directors, for failing to act in the company’s best interest when he negotiated the sale of his family’s shareholding to Saint-Gobain. Legal claims against specific members of a Board have a weaker legal basis in Switzerland than they would in the United States, and Urs Burkard’s spokesperson has so far dismissed the threat of such legal action.

In an additional layer of legal complexity, the Bill and Belinda Gates Foundation is now attempting to sue Urs Burkard, who represents the family and is the only member of that family on the Sika Board of Directors, for failing to act in the company’s best interest when he negotiated the sale of his family’s shareholding to Saint-Gobain. Legal claims against specific members of a Board have a weaker legal basis in Switzerland than they would in the United States, and Urs Burkard’s spokesperson has so far dismissed the threat of such legal action. On 15th September, the Swiss Competition Commission (COMCO) had little other choice than to unconditionally authorise the acquisition by Saint-Gobain of control over Sika, given the favourable ruling on that matter by the European Commission in July and the decisions made earlier by other competition regulators, particularly in China and in the USA.

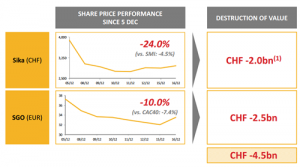

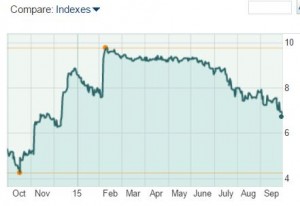

On 15th September, the Swiss Competition Commission (COMCO) had little other choice than to unconditionally authorise the acquisition by Saint-Gobain of control over Sika, given the favourable ruling on that matter by the European Commission in July and the decisions made earlier by other competition regulators, particularly in China and in the USA. Ultimately, what might block the deal is the threat to the reputation of Saint-Gobain’s, whose share capital is largely in the hands of institutional investors who will not be impressed by Saint-Gobain’s contempt for shareholders. If the deal goes ahead, Sika’s shareholders will forego the opportunity to benefit from the 78% premium being offered to the Burkard family, and face the prospect of future decline of their shares’ value. If the Bill and Belinda Foundation, whose backing of worthwhile causes is acclaimed the world over, is hit financially by the Sika Saint-Gobain transaction, Saint-Gobain may be faced with a well deserve torrent of negative PR.

Ultimately, what might block the deal is the threat to the reputation of Saint-Gobain’s, whose share capital is largely in the hands of institutional investors who will not be impressed by Saint-Gobain’s contempt for shareholders. If the deal goes ahead, Sika’s shareholders will forego the opportunity to benefit from the 78% premium being offered to the Burkard family, and face the prospect of future decline of their shares’ value. If the Bill and Belinda Foundation, whose backing of worthwhile causes is acclaimed the world over, is hit financially by the Sika Saint-Gobain transaction, Saint-Gobain may be faced with a well deserve torrent of negative PR.

The regulators in the United States and Canada are understandably concerned that from three major office supply chains in 2013, the market effectively would only have one such chain form 2016 onwards. Whilst Staples and Office Depot have each broadened their product ranges well beyond traditional stationery items, equipment and office furniture, to include also a range of associated services, the coming together of Staples and Office Depot gives a new meaning to “one stop shop” if there is no other shop to go to!

The regulators in the United States and Canada are understandably concerned that from three major office supply chains in 2013, the market effectively would only have one such chain form 2016 onwards. Whilst Staples and Office Depot have each broadened their product ranges well beyond traditional stationery items, equipment and office furniture, to include also a range of associated services, the coming together of Staples and Office Depot gives a new meaning to “one stop shop” if there is no other shop to go to!

That experience may definitely come well in hand if Staples and Office Depot are allowed to proceed with their dream, because in spite of the high percentage of post M&A integrations that fail, companies that have repeated or at least recent experience of post-M&A integration become better at it as they repeat that experience, avoiding the multiple traps and pitfalls into which the majority of the first-timers tend to fall.

That experience may definitely come well in hand if Staples and Office Depot are allowed to proceed with their dream, because in spite of the high percentage of post M&A integrations that fail, companies that have repeated or at least recent experience of post-M&A integration become better at it as they repeat that experience, avoiding the multiple traps and pitfalls into which the majority of the first-timers tend to fall.

The whole notion of market dominance is entirely dependent on how the market is defined. The commission’s panel has concluded that “customers would not face a reduction in choice, value or lower-quality service as a result of the merger“. A reduction in choice between what and what? After the merger, Britain will be left with only one major single-priced retailer, hence the CMA’s initial apprehension, but is that the environment within which consumers make their choice?

The whole notion of market dominance is entirely dependent on how the market is defined. The commission’s panel has concluded that “customers would not face a reduction in choice, value or lower-quality service as a result of the merger“. A reduction in choice between what and what? After the merger, Britain will be left with only one major single-priced retailer, hence the CMA’s initial apprehension, but is that the environment within which consumers make their choice?

Possibly the best way to understand the regulators’ thinking is to view “choice” as a moderator of pricing. If consumers view Scotch whisky as a more prestigious category than, say, Thai or Indian whisky, then owning a significant share of total Scotch whisky premium products can offer the potential to influence pricing upwards to fully capitalize on that favourable image, and even lead the way for lesser competitors within the segment to follow suit, in the absence of the pressure that would otherwise occur in a more fragmented market.

Possibly the best way to understand the regulators’ thinking is to view “choice” as a moderator of pricing. If consumers view Scotch whisky as a more prestigious category than, say, Thai or Indian whisky, then owning a significant share of total Scotch whisky premium products can offer the potential to influence pricing upwards to fully capitalize on that favourable image, and even lead the way for lesser competitors within the segment to follow suit, in the absence of the pressure that would otherwise occur in a more fragmented market.

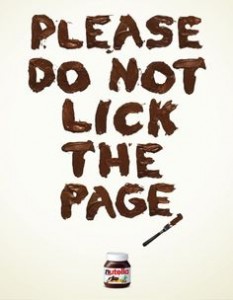

Both Thornton and Ferrero began as little corner shops; their history is closely associated with their founding families. But that is probably where the comparison stops. Whereas Ferrero developed over the years into a formidable marketing machine, a game changer in the chocolate industry, Thornton remained anchored in tradition. Oddly, it is that traditional image that appears to have attracted Ferrero; the remaining question being whether Ferrero will manage to brush away the “dusty” and “passé” aspects of that tradition, and fully exploit the concept of “authenticity” that underlies tradition. Given their strong track-record as powerful communicators, transforming the image of Thornton’s is probably not beyond Ferrero’s reach, but it will be quite a task…

Both Thornton and Ferrero began as little corner shops; their history is closely associated with their founding families. But that is probably where the comparison stops. Whereas Ferrero developed over the years into a formidable marketing machine, a game changer in the chocolate industry, Thornton remained anchored in tradition. Oddly, it is that traditional image that appears to have attracted Ferrero; the remaining question being whether Ferrero will manage to brush away the “dusty” and “passé” aspects of that tradition, and fully exploit the concept of “authenticity” that underlies tradition. Given their strong track-record as powerful communicators, transforming the image of Thornton’s is probably not beyond Ferrero’s reach, but it will be quite a task…

As a privately owned company, Ferrero does not need to disclose its strategy to the world, and nobody at this stage can be certain of what is going through Giovanni Ferrero’s mind. Does he really intend to revive the Thornton brand? Can the Thornton retail outlets be used as a channel for a premium Ferrero/Thornton range whilst Nutella, Ferrero Rocher and Kinder® products continue to flow through high-street shops and retail chains? How important are the Derbyshire factory and the know-how of some of its staff to Ferrero’s global manufacturing foot-print?

As a privately owned company, Ferrero does not need to disclose its strategy to the world, and nobody at this stage can be certain of what is going through Giovanni Ferrero’s mind. Does he really intend to revive the Thornton brand? Can the Thornton retail outlets be used as a channel for a premium Ferrero/Thornton range whilst Nutella, Ferrero Rocher and Kinder® products continue to flow through high-street shops and retail chains? How important are the Derbyshire factory and the know-how of some of its staff to Ferrero’s global manufacturing foot-print?

If we must be subjected to advertisements whilst watching a movie, following a sporting event or viewing news up-dates, I personally prefer such ads to be relevant; so I would not be too fussed if an ad for a physical activity tracker appeared on my screen, because I have been comparing such devices on-line lately and intend to acquire one to better monitor the calories I burn. But to some people, this may seem freaky, as if someone is permanently looking over their shoulder.

If we must be subjected to advertisements whilst watching a movie, following a sporting event or viewing news up-dates, I personally prefer such ads to be relevant; so I would not be too fussed if an ad for a physical activity tracker appeared on my screen, because I have been comparing such devices on-line lately and intend to acquire one to better monitor the calories I burn. But to some people, this may seem freaky, as if someone is permanently looking over their shoulder.

Alcatel-Lucent, like most of the major telecommunication equipment providers, is today the result of a number of acquisitions and business integrations. Alcatel and Lucent’s merger in 2006 triggered the merger of Nokia Networks with Germany’s Siemens. As an after-shock five years later, Ericsson acquired Nortel’s wireless networking business, prompting Nokia to buy out Motorola’s infrastructure division…

Alcatel-Lucent, like most of the major telecommunication equipment providers, is today the result of a number of acquisitions and business integrations. Alcatel and Lucent’s merger in 2006 triggered the merger of Nokia Networks with Germany’s Siemens. As an after-shock five years later, Ericsson acquired Nortel’s wireless networking business, prompting Nokia to buy out Motorola’s infrastructure division…

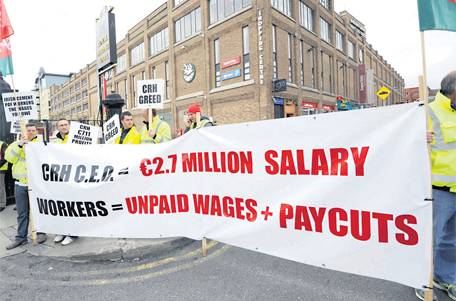

Just over a decade ago, uniting Holcim and Lafarge would have been unthinkable. Regulators used to spend their time and energy scrutinizing the cement industry to detect any signs of collusion between the key operators of what had already been an oligopoly for many years. But in today’s global scale economy, European regulators have become less shy about allowing the formation of giant companies capable of capturing sizable shares of the market in major European countries; after all, Europe needs a few such global heavy-weights to avoid being completely dwarfed by Asia and the Americas.

Just over a decade ago, uniting Holcim and Lafarge would have been unthinkable. Regulators used to spend their time and energy scrutinizing the cement industry to detect any signs of collusion between the key operators of what had already been an oligopoly for many years. But in today’s global scale economy, European regulators have become less shy about allowing the formation of giant companies capable of capturing sizable shares of the market in major European countries; after all, Europe needs a few such global heavy-weights to avoid being completely dwarfed by Asia and the Americas. Whereas the course of events in Europe has followed a well predicted roadmap, the unpleasant surprise on the path to Holcim and Lafarge’s union has now come from India where the regulators fear that the Holcim – Lafarge deal would cause a serious imbalance on their very vast and growing market. In an interesting and quite unusual move, India’s CCI (Competition Commission of India) required Holcim and Lafarge to publish the details of their proposed deal on their respective websites as well as in a selection of national newspapers, so that every interested party in the Indian subcontinent could have access to the relevant information and be given sufficient time to formulate comments and possible objections. This is only the second time that a merger proposal is submitted to general public scrutiny under Section 29(3) of India’s Competition Act, 2002.

Whereas the course of events in Europe has followed a well predicted roadmap, the unpleasant surprise on the path to Holcim and Lafarge’s union has now come from India where the regulators fear that the Holcim – Lafarge deal would cause a serious imbalance on their very vast and growing market. In an interesting and quite unusual move, India’s CCI (Competition Commission of India) required Holcim and Lafarge to publish the details of their proposed deal on their respective websites as well as in a selection of national newspapers, so that every interested party in the Indian subcontinent could have access to the relevant information and be given sufficient time to formulate comments and possible objections. This is only the second time that a merger proposal is submitted to general public scrutiny under Section 29(3) of India’s Competition Act, 2002.

In late August, the world’s largest breakfast cereal producer Kellogg Co expressed its interest in acquiring all or at least a controlling stake in Egypt’s Bisco Misr, the country’s reputed manufacturer of confectionary, cakes and biscuits.

In late August, the world’s largest breakfast cereal producer Kellogg Co expressed its interest in acquiring all or at least a controlling stake in Egypt’s Bisco Misr, the country’s reputed manufacturer of confectionary, cakes and biscuits.

However, being the world’s Nr 1 in an important consumer product segment and enjoying over 100 years of company history does not guarantee victory when it comes to seeking further expansion. Abraaj Asset Management, the middle eastern private equity company founded in 2002 in Dubai now growing towards global presence with hubs in Istanbul, Mexico City, Mumbai, Nairobi and Singapore, is ideally placed to understand the needs and potential of their nearby rapidly developing economies. No sooner had Kellogg revealed their intentions regarding Bisco Misr, that Abraaj jumped into the game and has since kept beating each of Kellogg’s bids.

However, being the world’s Nr 1 in an important consumer product segment and enjoying over 100 years of company history does not guarantee victory when it comes to seeking further expansion. Abraaj Asset Management, the middle eastern private equity company founded in 2002 in Dubai now growing towards global presence with hubs in Istanbul, Mexico City, Mumbai, Nairobi and Singapore, is ideally placed to understand the needs and potential of their nearby rapidly developing economies. No sooner had Kellogg revealed their intentions regarding Bisco Misr, that Abraaj jumped into the game and has since kept beating each of Kellogg’s bids.

For many, the west will be remembered for poking the fire and giving the population of many Arab nations the confidence of turning discontent into the outright uprising that spread like wild fire, which the west dubbed “The Arab Spring”. Spring is the season of new life, a season of clement weather after harsh winters, the flourishing of Nature with the promise of rich crops and prosperity. Instead, having praised the courage and determination expressed in the uprising that toppled governments across the region, many people will feel that the west did not have much to offer as a substitute nor much support to evolve towards renewed stability and governance, propelling many of those countries towards a wide vacuum which has left the door open to the sprouting of every form of extremism.

For many, the west will be remembered for poking the fire and giving the population of many Arab nations the confidence of turning discontent into the outright uprising that spread like wild fire, which the west dubbed “The Arab Spring”. Spring is the season of new life, a season of clement weather after harsh winters, the flourishing of Nature with the promise of rich crops and prosperity. Instead, having praised the courage and determination expressed in the uprising that toppled governments across the region, many people will feel that the west did not have much to offer as a substitute nor much support to evolve towards renewed stability and governance, propelling many of those countries towards a wide vacuum which has left the door open to the sprouting of every form of extremism. AB InBev’s power is very much centred in the Americas, where the growth prospects of a mature beer market are slowing down, whereas SAB Miller enjoys a very strong position in those markets that still have the potential to fuel substantial growth, notably in Africa. Consequently, although the combined group would be capturing around 30% of the overall world market for beer, the only area in which the combined market share is likely to be considered excessive is North America where SAB Miller could be asked to divest brands that currently enjoy a strong market position, such as Miller Coors, without causing a significant dent in its presence in other geographies.

AB InBev’s power is very much centred in the Americas, where the growth prospects of a mature beer market are slowing down, whereas SAB Miller enjoys a very strong position in those markets that still have the potential to fuel substantial growth, notably in Africa. Consequently, although the combined group would be capturing around 30% of the overall world market for beer, the only area in which the combined market share is likely to be considered excessive is North America where SAB Miller could be asked to divest brands that currently enjoy a strong market position, such as Miller Coors, without causing a significant dent in its presence in other geographies. AB InBev have built and demonstrated a remarkable ability in the area of cost cutting; there is no doubt that an acquisition of SAB Miller could generate further significant savings that would make the $120 billion deal worthwhile – after all, the guys at the helm of AB InBev have become absolute masters in the art of M&A and have not so far ever got it wrong. It is quite appropriate that AB InBev’s logo should include a hawk…

AB InBev have built and demonstrated a remarkable ability in the area of cost cutting; there is no doubt that an acquisition of SAB Miller could generate further significant savings that would make the $120 billion deal worthwhile – after all, the guys at the helm of AB InBev have become absolute masters in the art of M&A and have not so far ever got it wrong. It is quite appropriate that AB InBev’s logo should include a hawk…